June sees annual growth of 11.5% in total deposits, 6.5% in total loans: National Bank

- In June 2023, total deposits registered a monthly and annual growth of 1.2 percent and 11.5 percent respectively, due to the deposit growth in both sectors, with a larger contribution of the household sector, said the National Bank of North Macedonia in a press release Friday.

- Post By Angel Dimoski

- 14:15, 21 July, 2023

Skopje, 21 July 2023 (MIA) – In June 2023, total deposits registered a monthly and annual growth of 1.2 percent and 11.5 percent respectively, due to the deposit growth in both sectors, with a larger contribution of the household sector, said the National Bank of North Macedonia in a press release Friday.

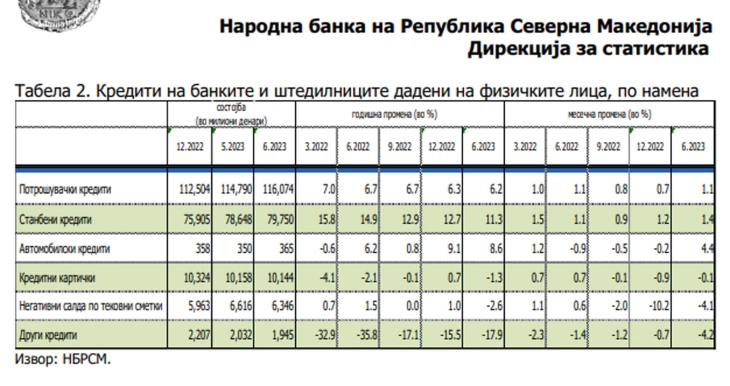

The annual growth of total loans by 6.5 percent reflects the higher lending to both sectors, which is slightly more pronounced in the household sector. In June, total loans recorded a monthly increase of 1.1 percent, driven by the growth in the lending to both sectors, with a larger contribution of the corporate sector.

The press release from the Statistics Department at the National Bank outlined the monetary developments in the country in June 2023.

“In June 2023, broad money (monetary aggregate М31,2) increased by 0.9 percent on a monthly basis, mostly due to the growth of demand deposits, short-term deposits and currency in circulation, with additional positive contribution of long-term deposits up to two years,” said the press release, adding that the annual growth of broad money amounts to 10.0 percent and is mainly a result of the higher demand deposits and short-term deposits, followed by long-term deposits up to two years and currency in circulation.

The National Bank said that total corporate deposits in June grew by 1.3 percent compared to the previous month.

“The upward change is due to the increase in both short-term and long-term denar deposits, amid additional positive contribution of demand deposits and short-term foreign currency deposits, while long-term foreign currency deposits declined. Annually, corporate deposits registered an increase of 19.7 percent, driven by the growth in all components, with the largest contribution of demand deposits and short-term foreign currency deposits,” said the press release.

The press release said corporate loans registered a monthly increase of 1.2 percent, due to the higher denar and foreign currency loans, with a larger contribution of denar loans. Compared to June last year, corporate loans increased by 6.5 percent, due to the higher lending in denars and in foreign currency, more pronounced in foreign currency loans.

Regarding household deposits, the National Bank said they increased by 1.2 percent on a monthly basis in June, mostly due to the growth of demand deposits and long-term foreign currency and denar deposits, amid slight increase in short-term denar deposits, while short-term foreign currency deposits declined. “The annual growth rate of 8.8 percent entirely results from the increase in demand deposit and long-term foreign currency and denar deposits, amid decline in short-term deposits,” said the Bank.

“In June, household loans registered an upward monthly and annual change of 0.9 percent and 6.4 percent, respectively. Analyzing the currency structure, the increase on a monthly and annual basis is due to the growth of lending in denars and in foreign currency, with a larger contribution of foreign currency loans,” said the press release.

Photo: Printscreen