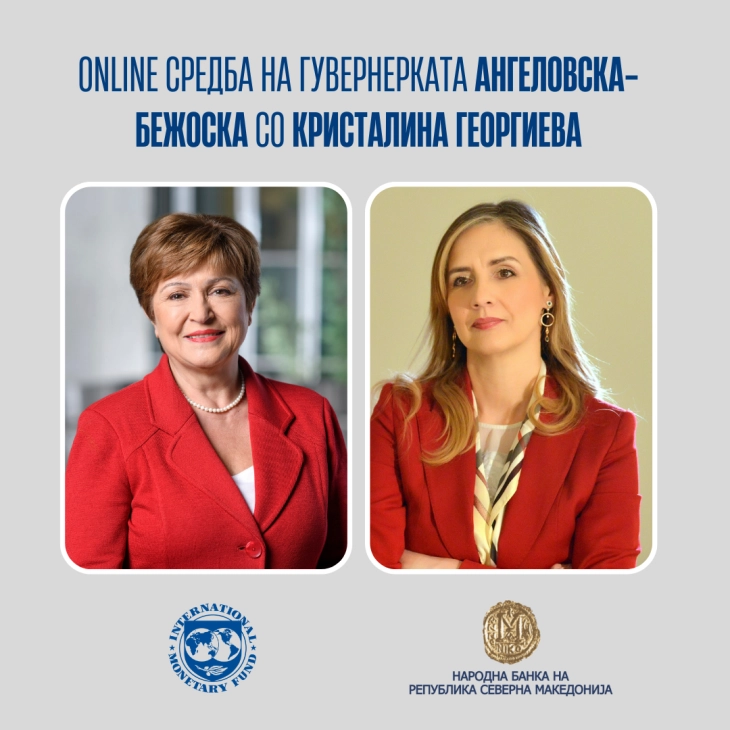

Angelovska Bezhoska – Georgieva meeting: Authorities taking strong policy measures to tackle crisis

- Post By Silvana Kocovska

- 13:04, 10 July, 2022

Skopje, 10 July 2022 (MIA) - Although the global economic outlook brings major challenges, the authorities are taking strong policy measures, concluded the International Monetary Fund (IMF) Managing Director, Kristalina Georgieva, during the online meeting with the National Bank Governor Anita Angelovska Bezhoska, Prime Minister Dimitar Kovachevski and Finance Minister Fatmir Besimi. IMF Managing Director highlighted her views on the appropriate economic policies on her Twitter account.

Proof of the appropriate policies is also the possibility of access to the Precautionary and Liquidity Line (PLL), through which the IMF will provide additional support for our country to overcome the current challenges, was discussed during the meeting, the National Bank said in a press release.

Namely, PLL is allocated to countries that have sound economic policies, practice and are expected to continue practicing sound economic policies and have macroeconomic stability. During the very approval process of this instrument, the monetary policy, the financial sector stability and supervisions, as well as the adequacy of the statistical data are also being assessed thereby.

The readiness of the IMF for the approval of the instrument shows that the National Bank successfully responds to the challenges in all these areas of its competence.

“In terms of the policies implemented by the National Bank, the primary goal and focus is still maintaining stability. The National Bank has started the process of gradual normalization of the monetary policy in order to maintain the medium-term price stability. Due to the growth of the prices of primary commodities in world markets and the slowdowns in the value chains, which also affect the other types of products, inflation registers upward movements worldwide. Taking into consideration the inflation developments, but also the foreign exchange market developments, the National Bank constantly uses all available instruments to manage liquidity and to affect interest rates. Actually, the National Bank interventions on the foreign exchange market, from the last quarter last year onwards, have been continuously decreasing liquidity, and in order to maintain its optimum level, the other instruments are also used, such as overnight deposit, seven-day deposit, repo operations and CB bills. The National Bank also made a new change to the reserve requirement, in order to affect the process of euroization in a more prudent manner, which further affects the demand on the foreign exchange market," reads the press release.